Exactly how to purchase Amazon (AMZN) shares

Amazon.com, Inc., established in 1994 by Jeff Bezos, is an international innovation and e-commerce firm headquartered in Seattle, Washington. Initially an on the internet bookstore, it has increased right into a wide variety of products and services, consisting of ecommerce, cloud computer, electronic streaming, and expert system. Significant offerings consist of the Amazon Echo, Kindle e-readers, Fire tablets, Amazon Prime, Amazon Internet Solutions (AWS), and Amazon Marketplace.

How to Acquire Amazon Shares in India through Exness

Exness, a leading online trading platform, offers Indian capitalists with the chance to buy Amazon shares. Below’s a step-by-step overview:

-

Open up an Exness account:

- Go to the Exness web site and enroll in an account.

- Total the Know Your Client (KYC) process by submitting the needed records.

-

Down payment funds:

- Transfer the preferred investment amount into your Exness trading account.

- Available repayment methods include financial institution transfer and UPI.

-

Select Amazon shares:

- In the Exness trading platform, search for Amazon shares (AMZN).

-

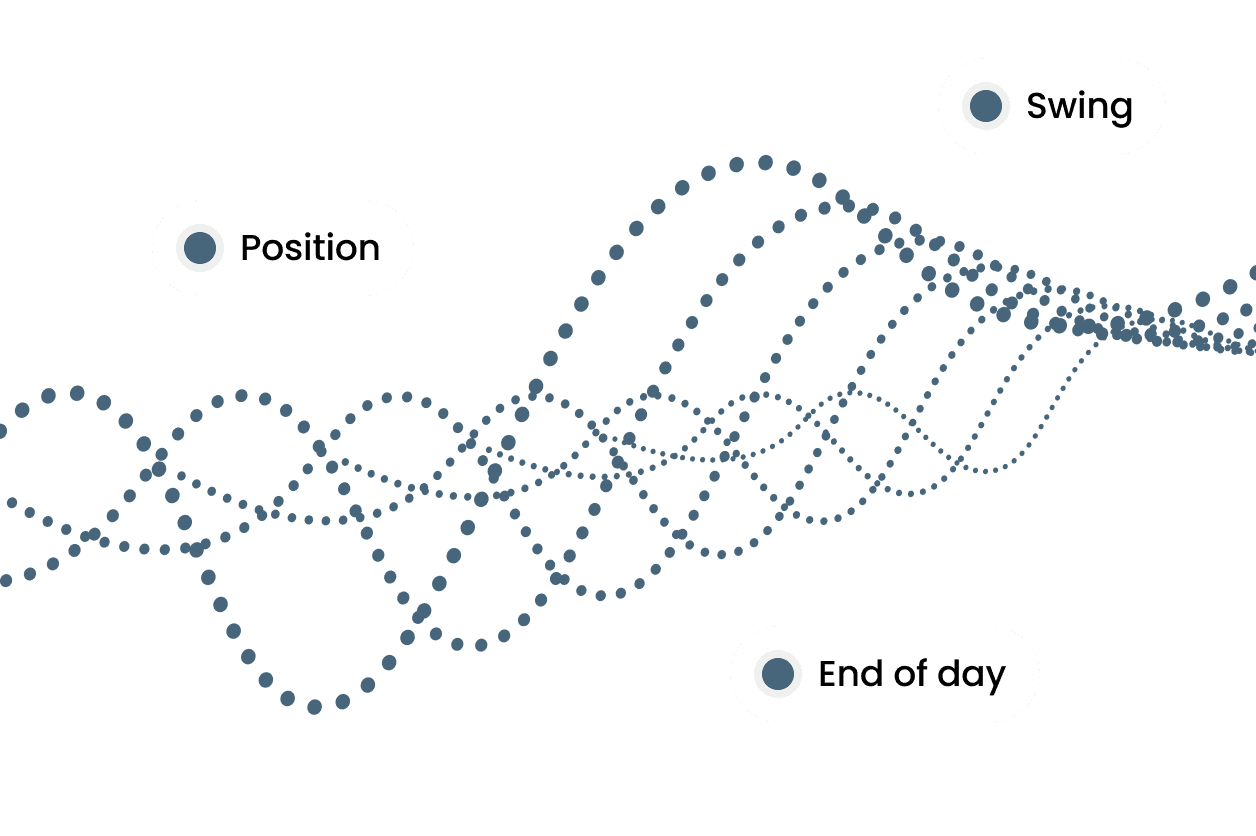

Position an order:

- Determine the number of shares you want to purchase.

- Establish the order type (market or limit).

- Place the order.

-

Confirm acquisition:

- Evaluation the order details.

- Confirm the acquisition.

- The shares will be credited to your trading account as soon as the order is performed.

-

Screen investment:

- Track your investment through the Exness system.

- Handle your portfolio as necessary.

you can find more here Exness official site from Our Articles

Alternative Ways to Buy Amazon through Exnes

In addition to straight buying shares, there are other means to buy Amazon through Exness:

-

Financial Investment Funds: Buying funds that include Amazon shares in their portfolio (e.g., ETFs or index funds).

-

Trading Robotics: Making use of mathematical trading systems that instantly open positions in Amazon shares based upon predefined specifications.

-

Social Trading: Duplicating professions of successful investors taking care of Amazon shares.

-

Options: Purchasing or selling options on Amazon shares for speculative or hedging objectives.

-

Crowdfunding: Buying startups or jobs connected to Amazon via crowdfunding systems.

These alternative approaches can be more complicated and riskier, so they need complete study and understanding of the underlying mechanisms.

| Threat Kind | Summary | Reduction Techniques |

|---|---|---|

| Market Threat | Supply rates vary as a result of various elements | Expand portfolio, long-lasting investment perspective |

| Volatility Threat | High cost volatility can result in losses | Use stop-loss and take-profit orders |

| Governing Danger | Changes in laws and policies can impact the business | Stay upgraded on governing advancements |

Financial Investment Threats and Reduction

When investing in Amazon shares or any other securities, there are particular dangers to take into consideration:

-

Market Danger: Supply rates can rise and fall because of various elements such as general financial conditions, political events, business financial efficiency, etc.

-

Volatility: High cost volatility can bring about significant losses in the short term.

-

Regulative Risk: Changes in regulations and regulations can affect the firm’s organization. To lessen these threats, financiers can:

- Diversify their portfolio by purchasing various possessions and fields.

- Usage stop-loss and take-profit orders to limit possible losses.

- Comply with long-term financial investment principles and stay clear of reacting to temporary rate fluctuations.

- Completely research the company’s monetary records and information.

- Use technical and essential evaluation devices.

Market Situation

Amazon runs in several sectors, primarily:

- Shopping: Significant rivals include Alibaba, Walmart, and other sellers investing in online channels.

- Cloud Computing: AWS controls, competing with Microsoft Azure and Google Cloud.

- Digital Streaming: Prime Video takes on Netflix, Disney+, and others.

Industry

Major Competitors

Shopping

Alibaba, Walmart, other merchants

Cloud Computing

Microsoft Azure, Google Cloud

Digital Streaming

Netflix, Disney+, others

Amazon holds considerable market share in each market, e.g., AWS has a 33% share in cloud facilities solutions. Its huge ecological community allows it to maintain a solid presence in spite of intense competition.

Affecting Elements

Inner Aspects:

- Innovation and Technology: Amazon continually invests in new modern technologies like AI and machine learning, enhancing functional performance and consumer experience.

- Diversified Organization Version: Revenue streams from ecommerce, cloud computer, electronic web content, and physical retail reduce threats associated with reliance on a single market.

External Factors:

- Regulatory Setting: Increasing scrutiny and regulations, especially worrying antitrust legislations, position obstacles.

- Economic Conditions: Fluctuations in the international economy can impact customer spending and organization investments, impacting Amazon’s earnings.

Azərbaycanda Rəsmi PinCo Kazino Saytı

Azərbaycanda Rəsmi PinCo Kazino Saytı